-

Compteur de contenus

38 347 -

Inscription

-

Dernière visite

-

Jours gagnés

75

Messages postés par José

-

-

JEFF SESSIONS' WAR ON MEDICAL MARIJUANA GETS PUBLIC HEALTH ALL WRONG

CitationIF THERE’S ANYTHING Jeff Sessions hates more than answering rapid-fire questions in front of a packed Intelligence Committee hearing, it’s a bag of stinky bud. The Attorney General’s distaste for marijuana is well documented. His Reefer Madness-era alarmism is so anachronistic it’s almost quaint. Or at least it would be if he weren’t using its outdated data to launch an attack on states’ rights to authorize medical marijuana.

In May, Sessions asked congressional leaders to roll back federal protections for the drug that have been in place since 2014, according to a letter that became public Monday. Known as the Rohrabacher-Farr amendment, these protections prevent the Justice Department from using federal funds to block states from crafting their own medical marijuana regulations. In his letter, Sessions complained that the amendment was keeping his department from enforcing other federal laws—namely, the Controlled Substances Act—citing the country’s “historic drug epidemic and potentially long-term uptick in violent crime” as justification.

Let’s put aside for a moment the fact that Session’s position directly contradicts the will of the American people; as of an April Quinnipiac poll, medical marijuana hit its highest levels of support in history, with 94 percent of voters approving of doctor-prescribed weed. Instead, let’s jump straight into why this is a totally bogus way to justify a new national drug enforcement policy.

While it’s true that yes, the US is in the midst of a “historic drug epidemic,” marijuana is not the drug that kills 91 Americans every single day. It is also not responsible for the quadrupling in overdose deaths in the US since 1999. In fact, according to the US Drug Enforcement Administration—which Sessions oversees—no deaths from marijuana overdose have ever been recorded. The epidemic the AG referred to is, of course, the deadly opioid sort—drugs like oxycodone, methadone, heroin, and fentanyl. No one is losing family members to some THC oil.

[...]

-

Will Trump Destroy the Dollar?

Citation[...] Fed independence has come to seem like a given, as solid as the independence of newspapers or the courts.

Until now, that is. Under President Trump, it is possible, for the first time in a generation, to imagine a concerted attack on the central bank. Conceivably, the United States could repeat the story of the mid-1960s and ’70s, when a 15-year period of central-bank independence was brought to an end by presidential bullying. Back then, Lyndon B. Johnson summoned the Fed chairman, William McChesney Martin Jr., to his Texas ranch and shoved him around the living room while proclaiming that low interest rates were imperative in a time of war. “Boys are dying in Vietnam and Bill Martin doesn’t care!” he yelled. Martin ultimately delivered the looser money that Johnson wanted. Richard Nixon followed up by publicly smearing Martin’s successor, Arthur F. Burns, until he, too, complied. Because Martin and Burns, unlike Greenspan, buckled, the U.S. went through the most extreme bout of inflation in its peacetime history.

[...] -

Brexit: l'économie britannique prise au piège de l'inflation

CitationL'inflation frôle désormais les 3% au Royaume-Uni, où elle atteint son plus haut niveau en quatre ans, une difficulté supplémentaire pour une économie déjà confrontée à de lourdes incertitudes sur les fronts du Brexit et de la politique intérieure.

En mai, la hausse des prix à la consommation a atteint 2,9% sur un an, une vigueur sans précédent depuis juin 2013, a annoncé mardi l'Office des statistiques nationales (ONS). Ce faisant, elle a dépassé non seulement les attentes des économistes interrogés par Bloomberg - qui tablaient sur 2,7% - mais aussi les prévisions de la vénérable Banque d'Angleterre - qui n'attendait pas un tel rythme avant la fin de l'année.

L'arrivée à ce niveau est d'autant plus brutale que les prix évoluaient encore autour de zéro à la fin 2015. Leur reprise, d'abord progressive, s'est accélérée d'un coup après la brutale dépréciation de la livre sterling à la suite du référendum du 23 juin 2016, les cambistes tablant depuis sur des perspectives plus difficiles pour le Royaume-Uni à cause du Brexit.

[...]

-

Frame within a frame... by Keisuke Tanaka

-

1

1

-

-

-

-

Lancia Stratos 1975

-

2

2

-

-

il y a 2 minutes, Arna a dit :

j'ai déjà perdu tout espoir libéral

Faut pas.

Le seul candidat qui a osé se définir comme libéral est devenu président.

-

1

1

-

-

Purée... ! C'est vraiment pétage de plombes en freestyle chez les ex-groupies fillonesques.

-

à l’instant, Kassad a dit :

Las Malvinas no son rojos ? Normal ?

Sur la carte interactive, le problème est mentionné.

-

il y a 9 minutes, tomrobo a dit :

Bon, c'est surtout une bataille d'érudits qui n'est pas concrétisée par une contestation juridique d'un gouvernement.

-

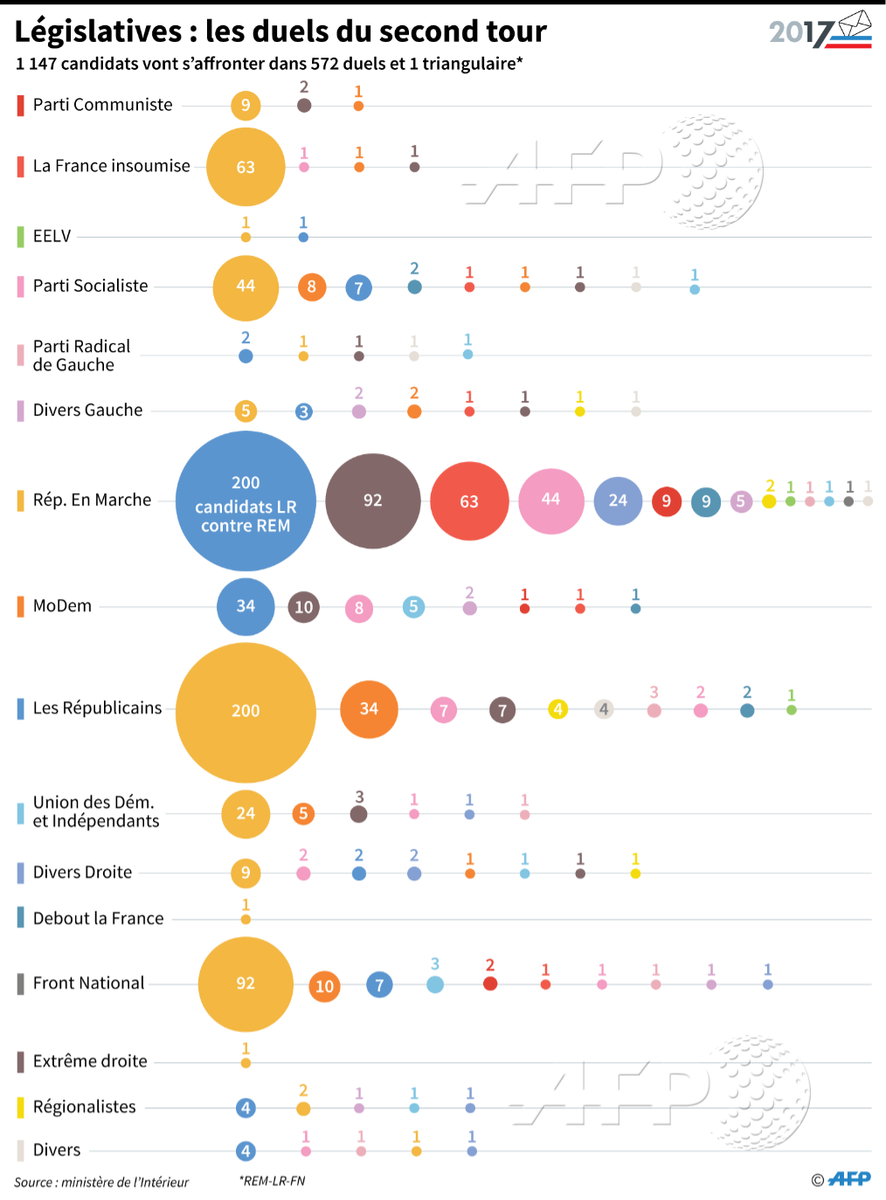

LREM a un candidat au second tour dans 453 circonscriptions (79% du total). C'est-à-dire plus que les trois partis suivants réunis (LR, 264 - FN, 119 - FI, 66)

-

il y a 11 minutes, Cortalus a dit :

Ça manque de Hitler quand même.

Suffit de demander...

-

-

-

-

il y a 18 minutes, Gilles a dit :

On se marre de plus en plus !

Pour les mélenchonistes, Macron, c'est Staline et Pinochet en même temps...

-

-

-

-

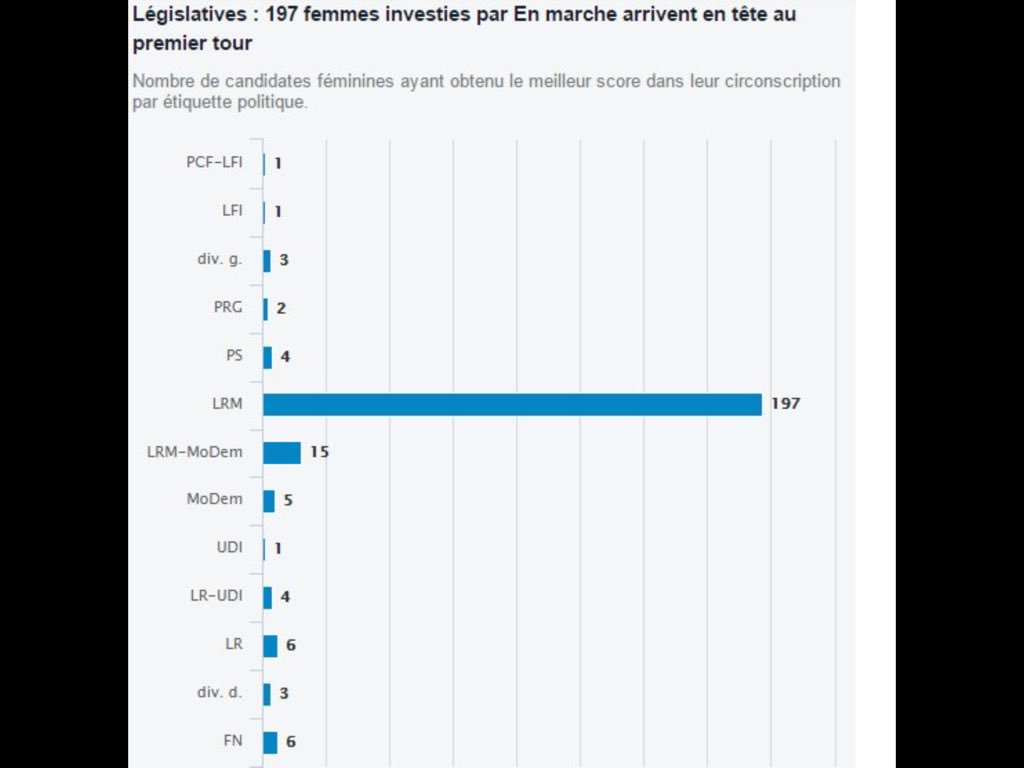

Il y a 23 heures, Marlenus a dit :

Sinon on se dirige vers l'assemblée la plus féminine de notre histoire.

Visiblement, LREM n'a pas joué la parité pour la gallerie : ils ont mis un max de femmes en position de gagner, contrairement à tous les autres partis.

-

1

1

-

-

-

Leandro Pérez Cadarso, architecte espagnol de 32 ans arrêté à la frontière américaine à Tijuana, emprisonné pendant 40 jours et déporté ensuite en Espagne... pour avoir visité les ruines romaines de Palmyre, il y a 6 ans.

http://politica.elpais.com/politica/2017/06/10/actualidad/1497115785_182365.html

-

Santé & nutrition, que manger ?

dans Sports et loisirs

Posté

Pour limiter le sucre : Sugar Skull Spoon